Value-added-tax rate increases: A comparative study using difference-in- difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

ESTIMATION OF INTERNATIONAL TAX PLANNING IMPACT ON CORPORATE TAX GAP IN THE CZECH REPUBLIC. - Document - Gale Academic OneFile

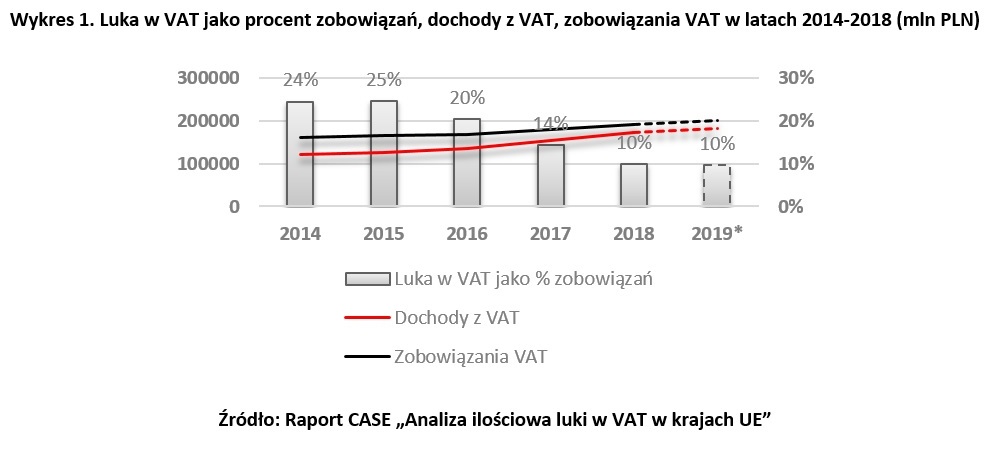

Luka w VAT w Polsce może wzrosnąć do 14,5% w 2020 r. - CASE - Center for Social and Economic Research

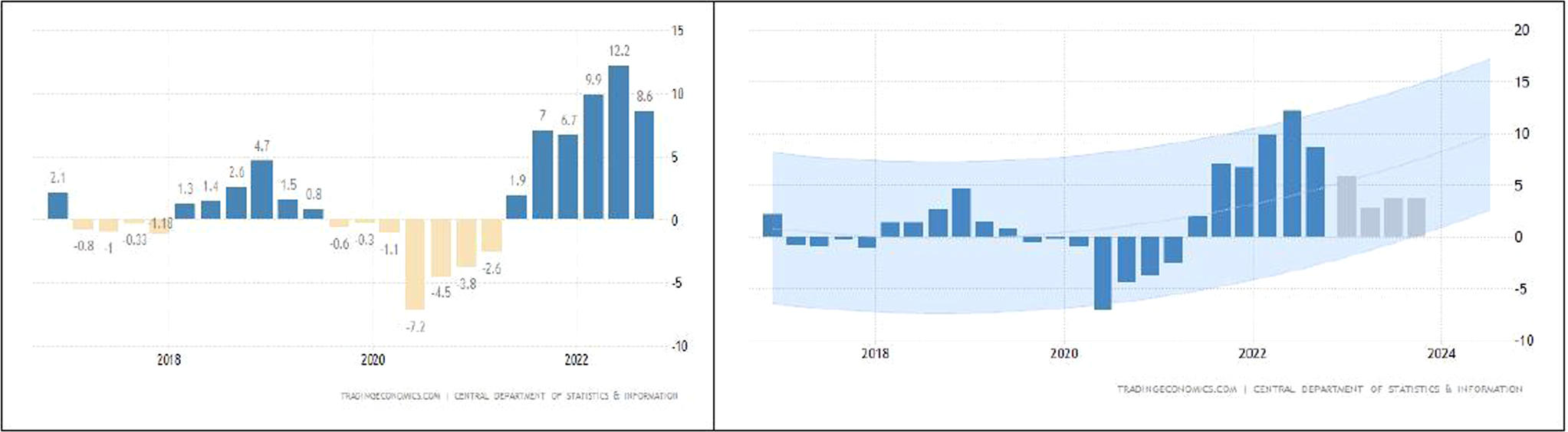

THE VALUE ADDED TAX (VAT) GAP ANALYSIS: CASE STUDY OF UZBEKISTAN – тема научной статьи по энергетике и рациональному природопользованию читайте бесплатно текст научно-исследовательской работы в электронной библиотеке КиберЛенинка

Republic of Poland: 2017 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Republic of Poland in: IMF Staff Country Reports Volume 2017 Issue 220 (2017)