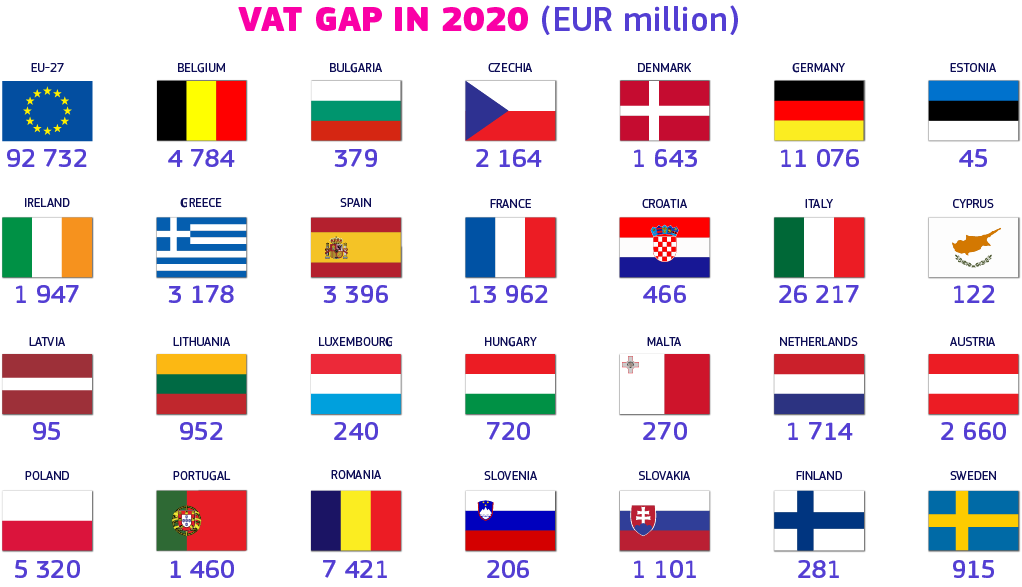

EU Tax & Customs 🇪🇺 on X: "#VAT Gap (difference between expected and collected VAT revenue) per country. More stats > https://t.co/LLdVPzqUTB https://t.co/XYSEjwxHhT" / X

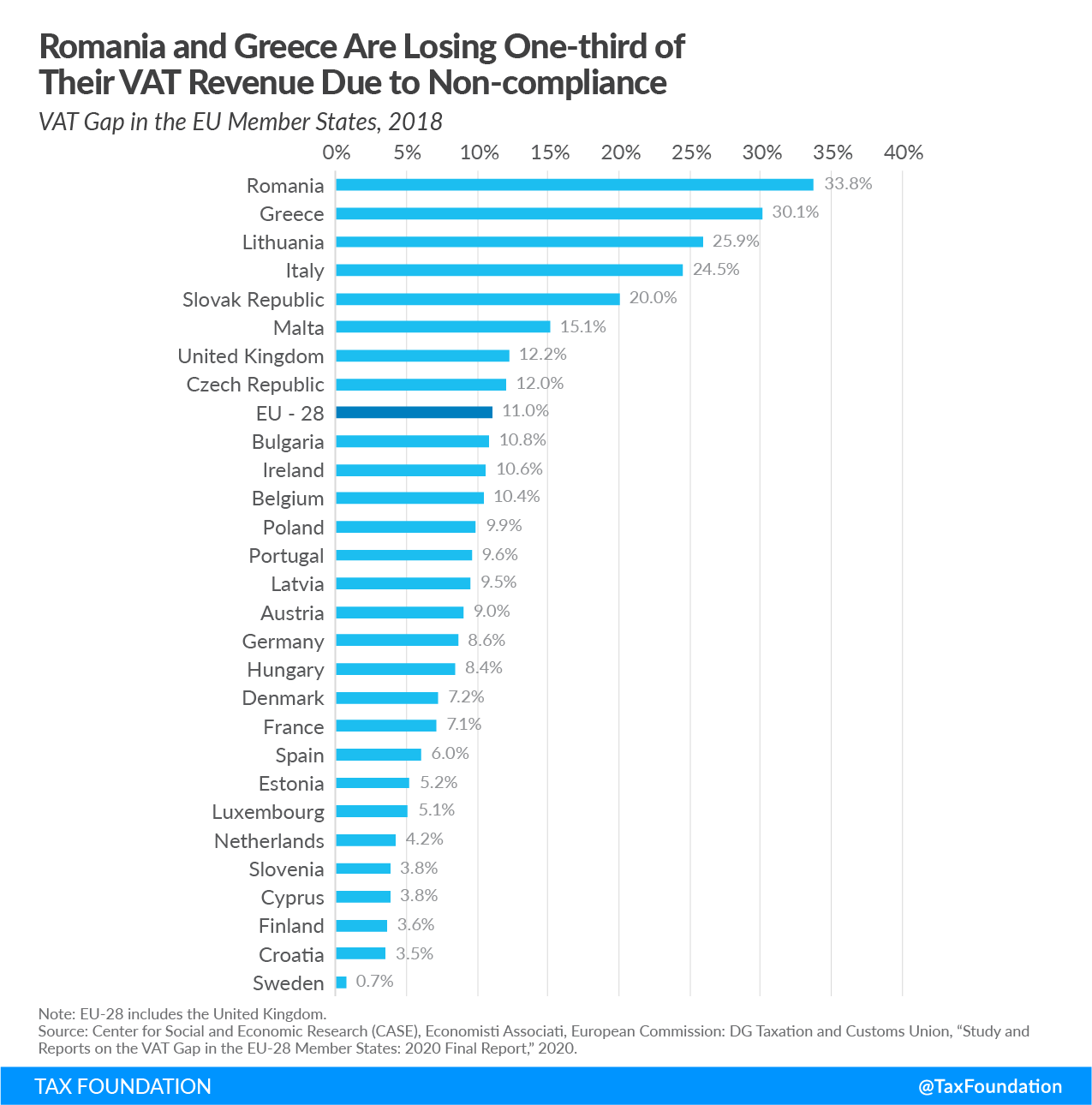

European Commission on X: "EU countries lost €137 billion in Value-Added Tax (VAT) revenues in 2017. To achieve more meaningful progress and reduce the #VATGap, we will need to see a thorough

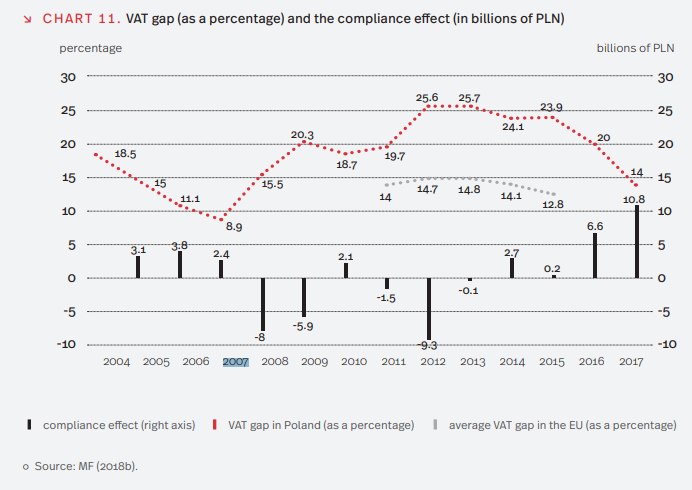

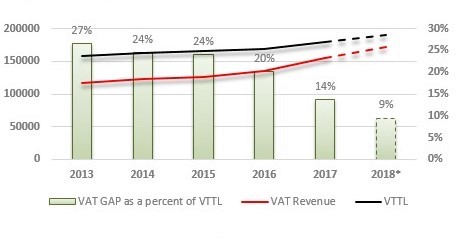

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

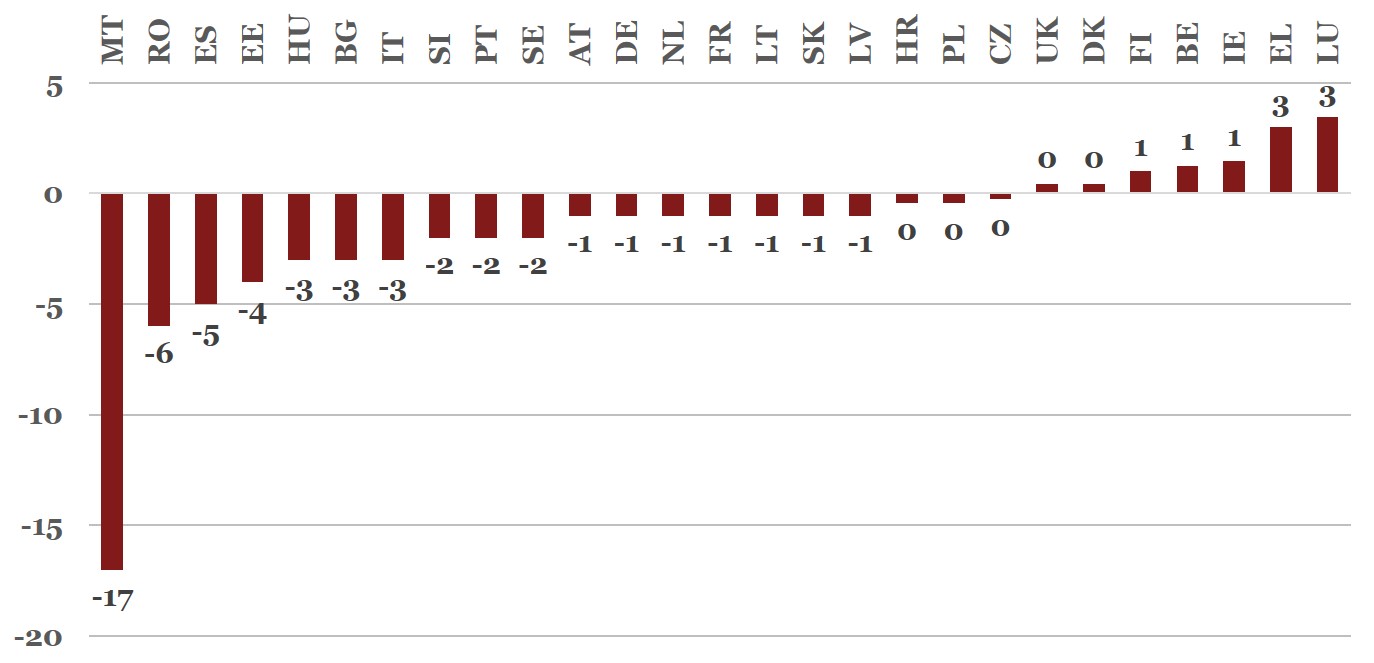

2. VAT Gap as a percent of the VTTL in EU-28 Member States, 2017 and 2016 5 | Download Scientific Diagram

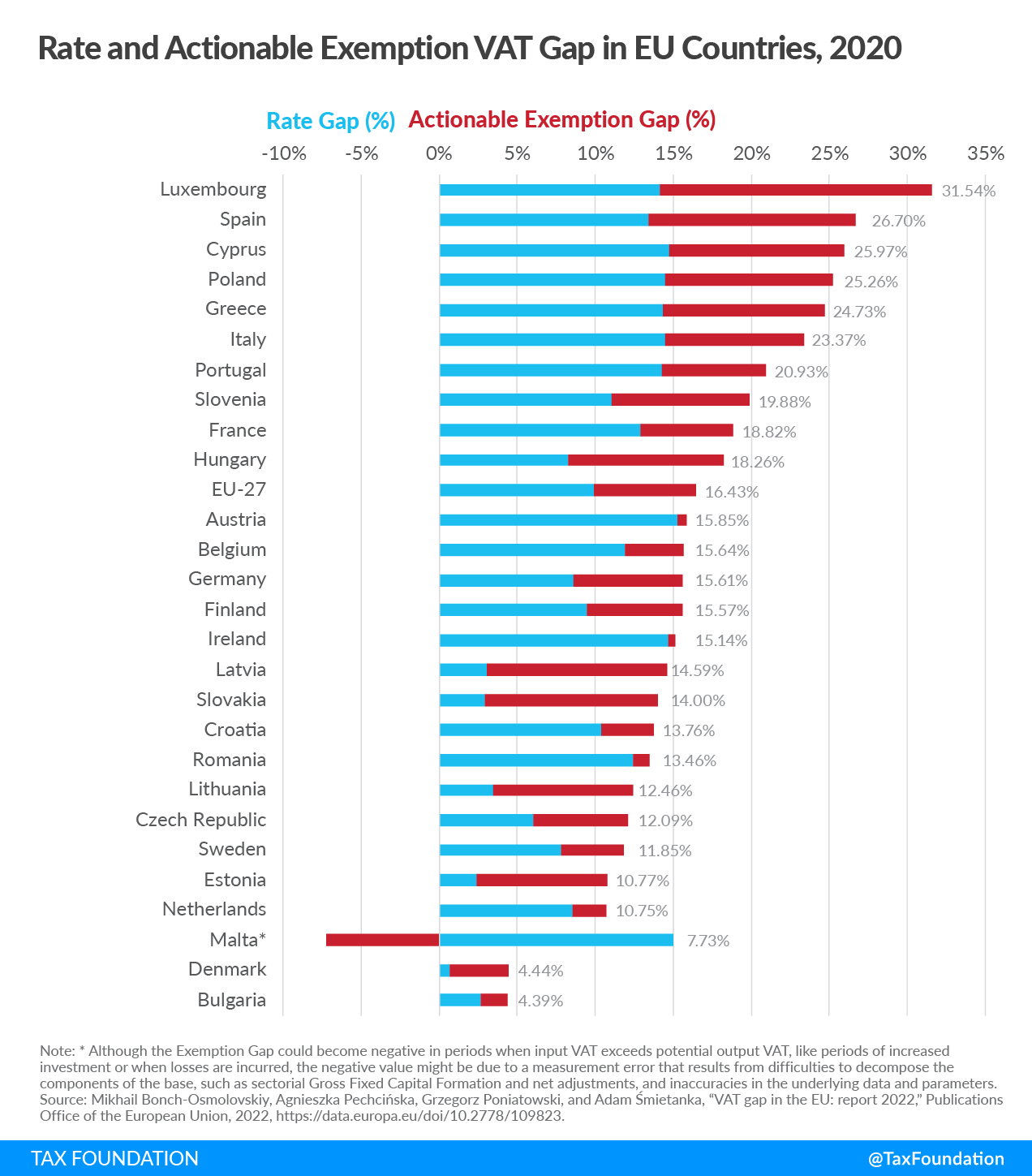

![PDF] Determinants of VAT Gap in EU | Semantic Scholar PDF] Determinants of VAT Gap in EU | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/aadd0ac1d940588d7c7f403ea66e313b4a056511/7-Table1-1.png)